What’s the maximum greet FHA DTI ratio?

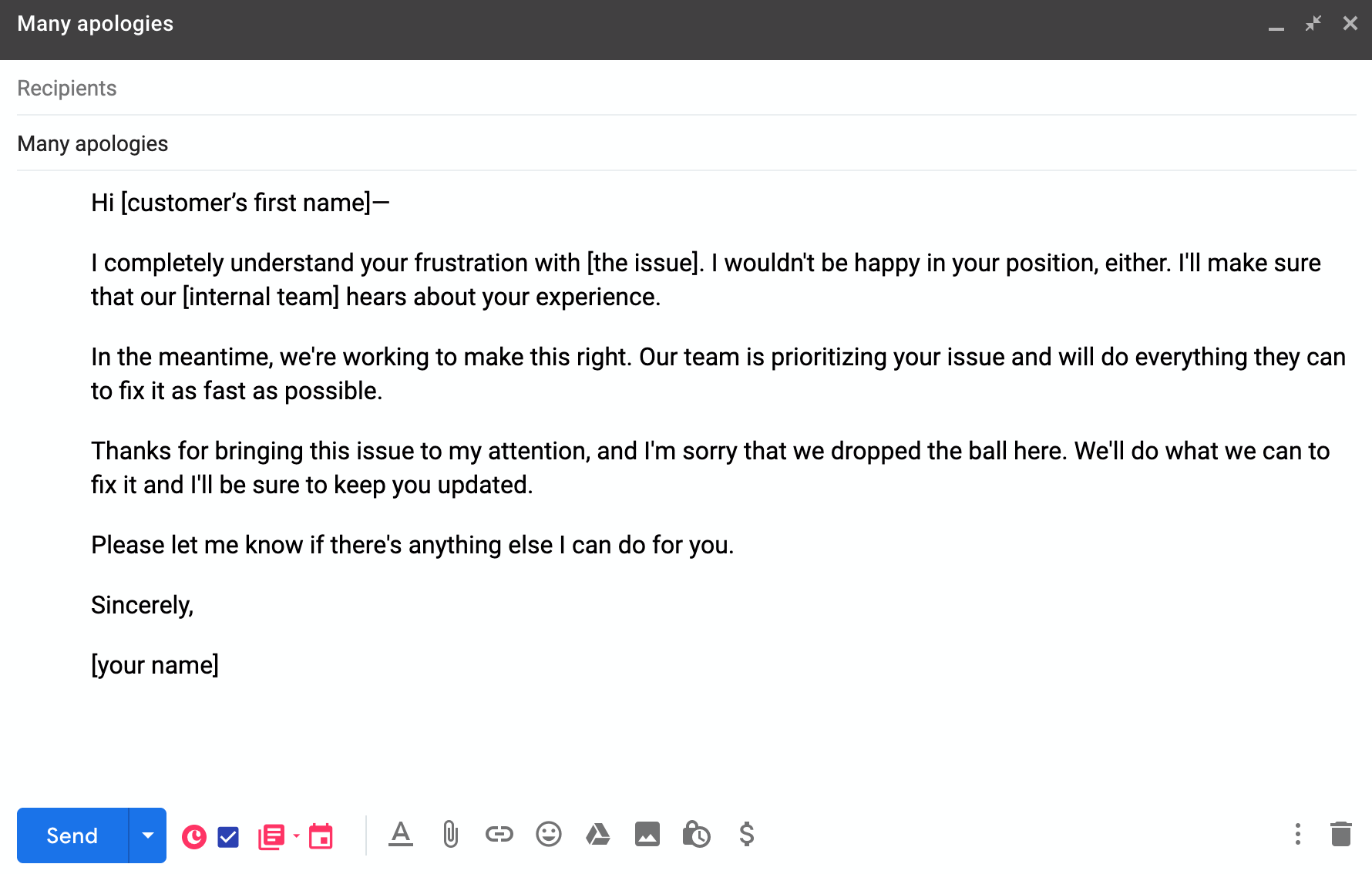

FHA Debt to help you Money Proportion Chart

That it chart commonly indicate what DTI is suitable depending their credit history. This also talks about certain compensating activities that may be needed so you’re able to qualify for the higher DTI account. Bear in mind this is just a basic guideline also it might be best to go over yours scenario because you still will get be considered even after what this chart says.

Tips reduce your DTI

There are many remedies for lower your DTI plus the most noticeable would be to both increase your monthly earnings or https://paydayloanalabama.com/marion/ decrease your month-to-month obligations. However, there are lots of smaller obvious information that individuals tend to share with your here.

Raise your Earnings When you are care about-operating or earn cash or information in your distinctive line of really works, this may be could well be crucial that you have the ability to file which income once you apply for home financing. The new error someone else build is not placing all of the income plus cash otherwise information towards the a checking account.

Loan providers will have to understand the circulate of money entering your own bank accounts. It doesn’t matter if or not you withdraw those funds soon afterwards. Documenting the cash is arriving is a method to enhance your noted terrible monthly money that in turn down the DTI rates.

Lower your Month-to-month Loans The DTI percentages are often driven up by the higher payment standards. If you are planning to pay down debt to aid the DTI percentages before applying getting a mortgage, you need to target your debt that has the biggest payment per month specifications, Not the debt that has the prominent harmony.

The target is to reduce people monthly premiums from your borrowing collection. Ergo, for those who have $5,000 accessible to lower obligations, you need those funds to completely pay off as much profile that one can. That would get rid of those costs from the DTI computation. Everything don’t want to carry out is apply the fresh $5,100000 against a free account who has a much larger harmony instead reducing the fresh new monthly payment.

The utmost greet FHA DTI Proportion with compensating items are 56.9% which can be greet of the performing FHA loan providers reliant particular compensating products that assist to attenuate the brand new lender’s chance.

What money are often used to estimate financial obligation to help you income ratios?

- Money out of your business

- Social security money

- 401k income

- Retirement benefits

- Impairment earnings

- Alimony and kid help

Must i be eligible for an FHA loan with high DTI? You’ll find loan providers that will allow to possess greater DTI profile doing as well as over fifty%. For many who performs closely on the proper financial, they will let direct you through the processes and can suggest a method to qualify.

Student loans and FHA obligations to help you earnings proportion FHA loan providers is actually required to play with 1% of one’s education loan equilibrium within the monthly premiums for the personal debt in order to earnings calculation. Understand the writeup on college loans for more info.

FHA Financial obligation to Earnings Ratio Calculator

Simply add your own advice in the areas below as well as the calculator will establish your own FHA loans to help you income ratios immediately. Should your back end ratio is over 43%, we continue to have lenders who can assist you with a mortgage. Hence, in the event the back end DTI less than is up to 60%, the other of one’s FHA loan providers can still have the ability to help you.

Regular Employment Are you useful sometime at the same lay otherwise are you presently moving from jobs in order to occupations with various gaps in work for the past while? Establishing a reputable source of income will be crucial.