What’s a Annual percentage rate getting Credit cards?

Apr represents apr. The new Annual percentage rate towards the a loan or any other debt offers a so much more complete picture of the way the personal debt will collect than simply your manage get on rate of interest by yourself. A Apr relies on your credit score and on the type of financial obligation you may be credit. If you need qualified advice connected with Apr and you can things from borrowing from the bank and you may personal debt, consider working with a monetary coach.

Annual percentage rate versus. Interest rate

If you like an excellent refresher, here is the difference between brand new Apr as well as the interest to your personal debt. The rate into that loan or financial obligation will not include people charges the borrower must pay, sometimes in the beginning of the loan or year round. The fresh Apr, in comparison, requires the brand new feeling of these fees and you can annualizes these to get a yearly commission (interest) rates.

Such as for example, in the example of home financing, the new I and financing origination fees. You have to know a full cost of what you’re borrowing from the bank before you begin using a charge card otherwise agreeing so you’re able to that loan. If you don’t, you will not have the ability to find out your budget appropriately.

The solution to practical question, What is an effective Annual percentage rate? depends on several circumstances. Simply, this will depend on prevailing rate of interest in the a given day. Loan providers will need the fresh You.S. Primary Speed or other simple directory and make her adjustments to that particular speed to increase their particular margins. Thus a person with debt now, whenever rates of interest was reasonable, keeps a significantly other practical for just what renders a good Apr than anybody regarding the highest-attention ’80s did.

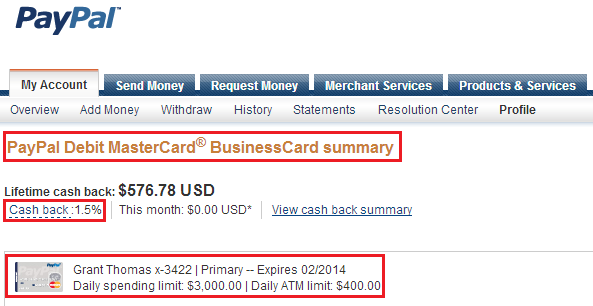

Brand new Apr nowadays will additionally trust your borrowing from the bank. A minimal charge card Annual percentage rate for somebody with sophisticated credit you’ll getting twelve%, while you are an effective Annual percentage rate for anyone with the-very borrowing from the bank could be on the large teens. If good means finest available, it would be to twelve% to possess personal credit card debt and you may as much as 3.5% for a 30-12 months home loan. But again, these wide variety change, either day by day. And in the truth regarding mortgages, the fresh best APRs are usually on 15-seasons mortgages and you may varying-price mortgages, which can not good monetary choices for every user.

Of many different debt include more than one ple, for those who skip an installment on your own personal credit card debt you is bumped so you’re able to a penalty Annual percentage rate that’s higher than simply your own typical Annual percentage rate. It requires months to help you encourage their lender to end billing the penalty Annual percentage rate and you can get back that the normal price.

The new 0% Annual percentage rate, Informed me

With auto loans and you will credit cards, you can find advertising having obligations which have an excellent 0% Annual percentage rate. That doesn’t mean which you can never ever shell out any focus in your personal debt. Rather, it’s a basic promote. Depending on how you handle it, it can be the opportunity otherwise a trap. If you are using a great 0% Annual percentage rate to make a balance transfer off a previous mastercard then pay-off your debts until the 0% Annual percentage rate ends plus rate of interest leaps, you will have emerge to come.

But if loan places Tallassee you carry out a balance transfer and possess a harmony in the event the speed leaps to, say, 20% you may be worse away from than for people who had not annoyed having the bill import. And you can one which just perform an equilibrium import, it’s always important to see if there are any fees for the fresh new import. Those people costs is negate the latest savings regarding a low otherwise 0% basic Annual percentage rate.

The same goes for a vehicle. If you purchase an even more expensive auto than you might comfortably manage as you happen to be seduced by the 0% Apr, you could miss repayments just like the real ages your credit rating. You could end up getting the auto repossessed and you will losing the newest automobile you should get to get results.

How to Reduce your Credit Card’s Annual percentage rate

Once you commit to credit cards with specific laws and regulations, including the Annual percentage rate, it may be difficult to find they people lower. This new rates aren’t generally altered just considering a good credit score efficiency through the years. The credit bank increases your own credit line on your card for one save money but the e. Discover basically one or two ways you can buy a lower Annual percentage rate in your handmade cards.

- Require a reduced Apr. If you believe just like your Apr are going to be reduced predicated on your credit overall performance you might simply telephone call your own bank card business and ask. Many people which ask get a reduction in their Apr.

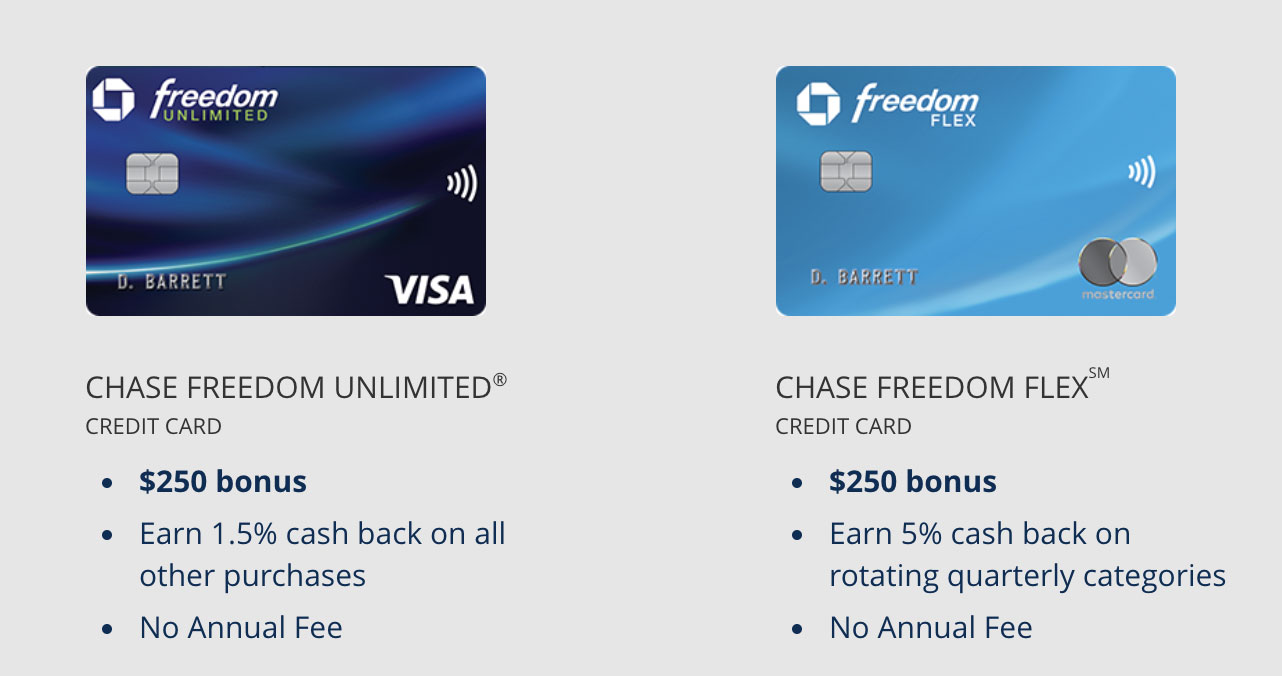

- Score a new credit card. You will never become charged notice getting a cards you never use. If for example the borrowing provides enhanced then you may rather sign up for credit cards having a lower Apr and make use of you to definitely card shortly after acceptance.

The bottom line

This new Apr is actually an invaluable equipment getting researching the cost of borrowing money. Exactly why are a great a Apr relies on several points, it is therefore always a good tip in order to check around before taking towards obligations, also to run boosting your credit history. If you find yourself unclear about the actual-business impact away from an apr, think your hold an excellent $100 equilibrium on your mastercard all year. The fresh ount you’d pay for the focus over the course of you to definitely season.