What forms of Contrary Mortgage loans Arrive?

What is the minimum many years significance of a reverse home loan? Always, 62. Before you have made this kind of mortgage, find out about the dangers, and you may consider other available choices.

Contrary mortgages are usually claimed because the an effective way for cash-strapped more mature homeowners and availableloan.net/payday-loans-in/hammond/ you may retired persons to track down spending-money without needing to give-up their houses. Constantly, minimal decades having needs an opposing home loan is 62. Occasionally, you’re able to get you to definitely if you find yourself young, instance, just after flipping 55.

However they are these types of mortgage loans all of that great? Reverse mortgages is difficult, risky, and you can pricey. And in of numerous points, the lending company is foreclose. Providing a contrary mortgage always actually wise, even though you meet up with the minimum decades requirement.

Just how Reverse Mortgages Work

Which have a face-to-face mortgage, you take away financing resistant to the security of your house. In place of having a routine mortgage, the lending company makes costs for your requirements with a face-to-face home loan.

The mortgage must be repaid once you pass away, circulate, import title, otherwise sell your house. not, for people who breach the brand new regards to the loan package, the lender you are going to call the borrowed funds due earlier.

Of course, if you do not pay back the borrowed funds once the lender accelerates they, you might treat the home so you’re able to a foreclosure.

Family Collateral Conversion Mortgages

Brand new Federal Property Administration (FHA) insures HECMs. It insurance professionals the lending company, maybe not the fresh citizen. The insurance coverage kicks inside when the debtor non-payments on loan while the house actually really worth enough to pay-off the lender in full through a foreclosure product sales or some other liquidation procedure. The new FHA compensates the lender towards the losings.

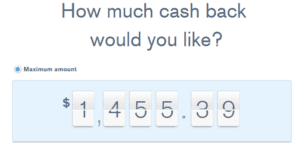

To obtain a good HECM, you must satisfy rigorous requirements having approval, along with at least many years requisite. You could discovered HECM money when you look at the a lump sum payment (susceptible to certain limits), because the monthly payments, given that a credit line, otherwise because the a combination of monthly installments and a line of credit.

Proprietary Reverse Mortgages

Proprietary contrary mortgages are not federally insured. This contrary home loan could be a great “jumbo contrary financial” (only people with quite high-really worth home may him or her) or some other sort of opposite mortgage, such as for instance one targeted at somebody age 55 as well as.

Other sorts of Reverse Mortgages

Another kind of contrary home loan are good “single-use” reverse mortgage, and that is called a “deferred percentage mortgage.” This reverse mortgage try a want-depending financing to own a new goal, such expenses property fees otherwise spending money on household solutions.

Opposite Home loan Ages Conditions and Eligibility

Again, minimal age need for a beneficial HECM opposite financial are 62. There is absolutely no higher decades limit to track down good HECM reverse mortgage.

Contrary mortgage loans lack credit otherwise money criteria. The amount you might obtain will be based upon your own house’s worth, current interest levels, along with your years. Plus, simply how much of your own residence’s well worth you might extract is actually limited. Since 2022, probably the most currency available with a HECM is $970,800. Also, a debtor might get only 60% of the loan at closing or in the original season, subject to a number of conditions.

- You must live-in the home as your dominant house.

- You’ll want generous security throughout the property or individual the fresh domestic outright (definition, you do not have a mortgage inside).

- You can not be delinquent on the a national financial obligation, such as for instance government taxes otherwise federal college loans.

- You need to have savings accessible to pay constant property can cost you, such as house maintenance, property taxes, and you can homeowners’ insurance.

- Your house must be from inside the great condition.

- The home have to be a qualified possessions form of, such as for example a single-family home.