Performs this sound like the type of mortgage to you personally?

- See a lending company: Working with a home loan company who has got experience with the new Va mortgage http://www.clickcashadvance.com/personal-loans-mo/riverside procedure ‘s the 1st step during the securing an excellent Va home loan. The best bank will be able to offer you advice related to brand new housing industry close by and you will Virtual assistant mortgage requirements, plus Va mortgage entitlement and mortgage choices youre qualified to have.

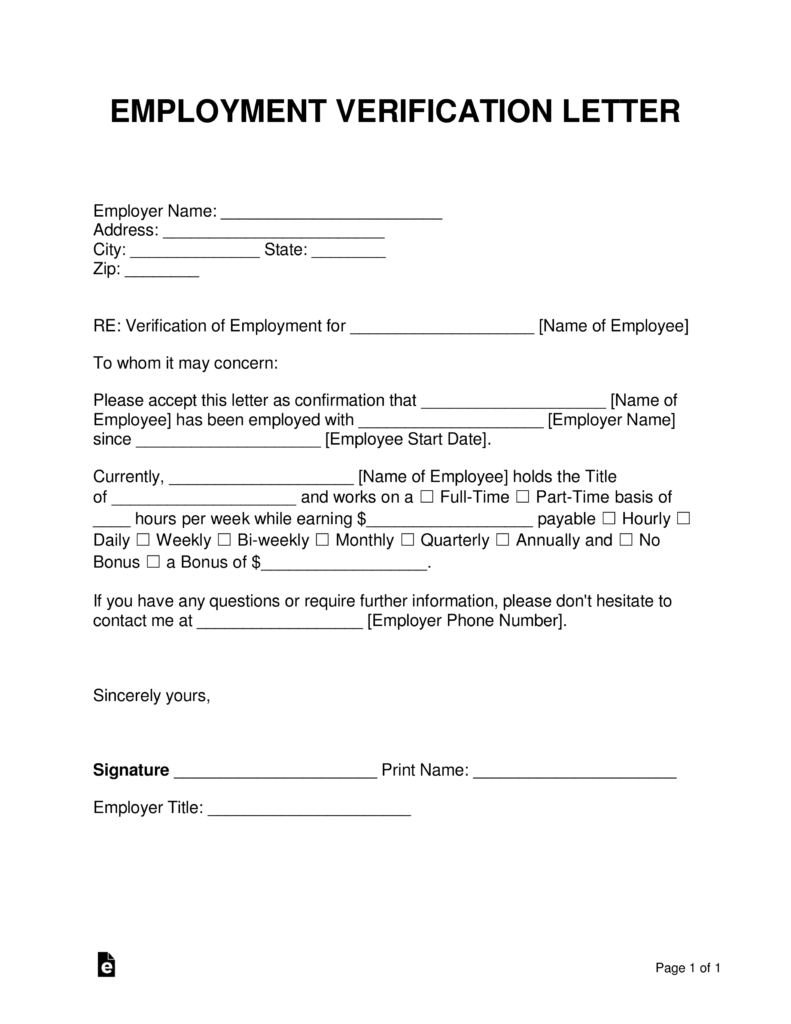

- Obtain a certificate from Qualification: After you’ve discover your own home loan company, it is the right time to see their Certification out-of Eligibility (COE). It document will inform the lender you be considered to have a good Va loan and also the matter the Virtual assistant will make certain on your mortgage.

- Look for a home and you will indication a binding agreement: Seeking a home has become the most exciting element of the process. Making use of the suggestions provided by the financial and also the Va, you could work on a representative to obtain a home one you really can afford and signal a contract with the knowledge that you have the fresh new Virtual assistant mortgage backing.

- Sign up for good Virtual assistant mortgage: Once you’ve finalized a contract order your brand new home, you will need to sign up for brand new Va mortgage that coverage the particular cost of your house. With most Va loan issues, you will not need a down-payment, which will help create homeownership economical. Just be sure to give their financial on the appropriate paperwork proving earnings and you may financial assets and debts, exactly like antique mortgages.

- Romantic to the family: Once your bank has actually canned appropriate files and you’ve got become approved with the latest financing, might sign brand new records and you may ready yourself to maneuver to your brand new home.

We Work on Armed forces Homebuyers

Griffin Money is happy to incorporate earliest-go out military homebuyers having choices to pick a different house thanks to the Virtual assistant gurus. We possess the feel to work with you since a first-time army house buyer, and will help make the process even more clear and much easier to help you cope with. We all know one to to shop for a home would be a huge step, and you may swinging can cause more stress since you really works doing your own military functions. Hence, we seek out alleviate some of those stresses for you and your loved ones.

Based into the 2013, Griffin Investment is actually a nationwide shop lending company concentrating on getting 5-star provider in order to the customers

Whether you’re a military first-time domestic buyer or provides possessed a house in earlier times, their Va masters can help with financing a property and you will helping to attenuate the entire price of homeownership. Contact Griffin Financing now and start the whole process of protecting good Virtual assistant home loan just like the a first-date buyer.

Bill Lyons ‘s the Creator, President & President regarding Griffin Financial support. Mr. Lyons has actually twenty two many years of experience in the mortgage organization. Lyons is seen as a market commander and you will expert when you look at the real house financing. Lyons has been appeared in Forbes, Inc., Wall Road Diary, HousingWire, and. Once the a member of the mortgage Lenders Association, Lyons may be able to keep up with extremely important changes in this new world to transmit the most well worth so you’re able to Griffin’s subscribers. Below Lyons’ leaders, Griffin Resource makes the fresh Inc. 5000 quickest-expanding businesses record five times within its ten years in operation.

So you can qualify for good Virtual assistant loan, borrowers must meet certain qualifications. The original requirements is that the borrower is effective-obligation, an effective reservist, an experienced, or an eligible surviving lover of among six twigs of You.S. army or Federal Guard. So you can discover Va home loan benefits, this service membership representative or experienced must see particular provider date conditions, and their eligibility is confirmed when you look at the a file it located in the Virtual assistant called a certification out of Qualification (COE).