Mobile View Put Faq’s

Content

The new go out must be the few days, day, and you can year your submitted the newest deposit. Store your own register a secure location for thirty days after your put, next damage it. A keen AdvanceConnect prepaid membership guarantees you are constantly happy to discovered calls. As you spend ahead of getting entitled, you will find never a disturbance in-service for as long as the newest account has money available. You can add numerous TDCJ entered telephone numbers compared to that membership plus inmate is also name any of these amounts as long since there is an adequate balance to cover the decision. You might manage your account online or that with the Securus Cellular Application to provide phone numbers, setup automated payment choices and you will perform almost every other account government functions.

- Under your trademark, you’ll should also create particular type of your own conditions “to possess mobile deposit just,” depending on what your financial or credit partnership means.

- Your own put amount was put into your future month-to-month cellular phone costs.

- Other weapon sales law planning feeling at the time of Saturday requires credit card percentage sites to provide an alternative pinpointing code to possess firearm and you may ammo retailers.

- The fresh rise in popularity of online financial, head put and you will fellow-to-fellow fee software have shorter how many monitors that folks found.

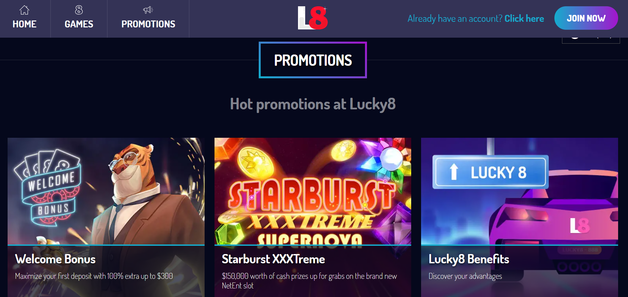

It features all of the greatest casino games, and next https://mrbetlogin.com/dragon-drop/ to 800DraftKings ports, 80 desk games, and some video poker andlive agent titles. Dependent on what services and products you are interested in, on line speak can be available. You will see an association or perhaps acceptance to have a chat whenever agencies are available. Camilla have a back ground inside news media and you may team communications.

Get A primary Deposit Mode Out of your Employer

So it account is actually belonging to the brand new inmate but you can build deposits to assist them to finance these types of correspondence and you can activity features. For many who haven’t used JPay Email address, you’ll must create a Securus account (if you wear’t have one) after which register for Securus eMessaging. Over recommendations are in the newest Getting started off with SECURUS EMESSAGING (to have low-JPay Mail profiles) area less than. You could potentially shell out your own book, mortgage, bank card or any other bills that have Pursue On the web℠ Statement Shell out.

Install A nullified View Otherwise Put Slip, If necessary

The new commission method is mostly local plus it primarily would depend when the your service provider supporting it. Otherwise, you can always fool around with other mobile payments with your unit by including credit cards to help you elizabeth-wallets. The greatest ripoff to help you spending making use of your month-to-month cellular telephone expenses is actually that lots of internet sites where you are able to legitimately play will not have it payment approach available for you and then make your first put. They drops at the rear of almost every other mobile device options such Fruit Pay, Google Spend, and much more with regards to availableness that have cellular bookies. Having fun with spend because of the cell phone making repayments in the casinos is becoming ever more popular, but exactly how much does it cost? This short article mention if there’s a fee for having fun with the newest percentage approach and you will what to watch out for when choosing whether to make use of this choice.

Phone in, Up to $five hundred Cash-out

If you’re also seeking make your earliest move into casinos for United kingdom professionals, you might deposit the cash through cellular through the possibilities less than. One another actions use your portable expenses to create in initial deposit at the casinos on the internet. However, there are many slight differences between both.

For example, with Navy Federal Credit Union , you might put up to ten checks each day, to a total of $50,one hundred thousand per day. Lender, deposits are simply for $50 on the specific membership one haven’t been unlock for around 3 months. If someone else on your own household dumps a check through mobile app as opposed to letting you know, you could potentially put it a second time. Whenever an error like this goes, certain banking companies merely email you to definitely alert you to your issue. Anyone else often strike you having a good “backup presentment” charge.

So it percentage is frequently a small % of your view, up to 1% so you can cuatro%. Regarding the banking community, these types of digital transactions try known as remote put take. They’re processed myself from financial’s digital system, plus the study you send out are protected by encryption. And, as opposed to inside-individual look at places, you receive an immediate electronic verification otherwise bill immediately after making a good mobile view put. To possess a cellular view deposit getting canned, it must be appropriately supported. For those who’lso are maybe not after the laws—signing it and you will creating particular kind of “to possess mobile put only” on the back—following there’s a go the brand new put was refused.

Definitely feel the latest kind of the banking application installed. Discover a confirmation so that you understand immediately your put provides already been received. After both parties are grabbed, you could select the right membership for the new deposit … next enter the amount.

So why do Bettors Love to Shell out Because of the Cellular phone Gambling enterprises?

These types of gambling has become ever more popular lately because will bring a handy method for visitors to gamble as opposed to being forced to have fun with notes and other payment procedures. To your increase out of mobile tech, more about gambling enterprises have to give you shell out from the mobile phone gambling choices very professionals can also enjoy the brand new thrill away from real-currency gaming at any place. Having mobile consider put, you could potentially deposit a check for the checking or savings account by using photos from it on your own financial application. That it free of charge solution, that is supplied by really banking institutions and borrowing unions, is available twenty four/7 and takes in just minutes to complete in your mobile phone or pill. More banks and you can borrowing from the bank unions have to give mobile view put because the a handy means for people to provide currency to their membership.