In this article, we delve into the world of HomeReady fund, demystifying the has, experts, and you may qualification requirements

For many ambitious people, selecting an inexpensive way to homeownership feels instance a faraway fantasy. HomeReady financing is actually a unique and versatile mortgage alternative built to get this to fantasy a real possibility having a greater variety of anyone and you may household.

What exactly are HomeReady fund?

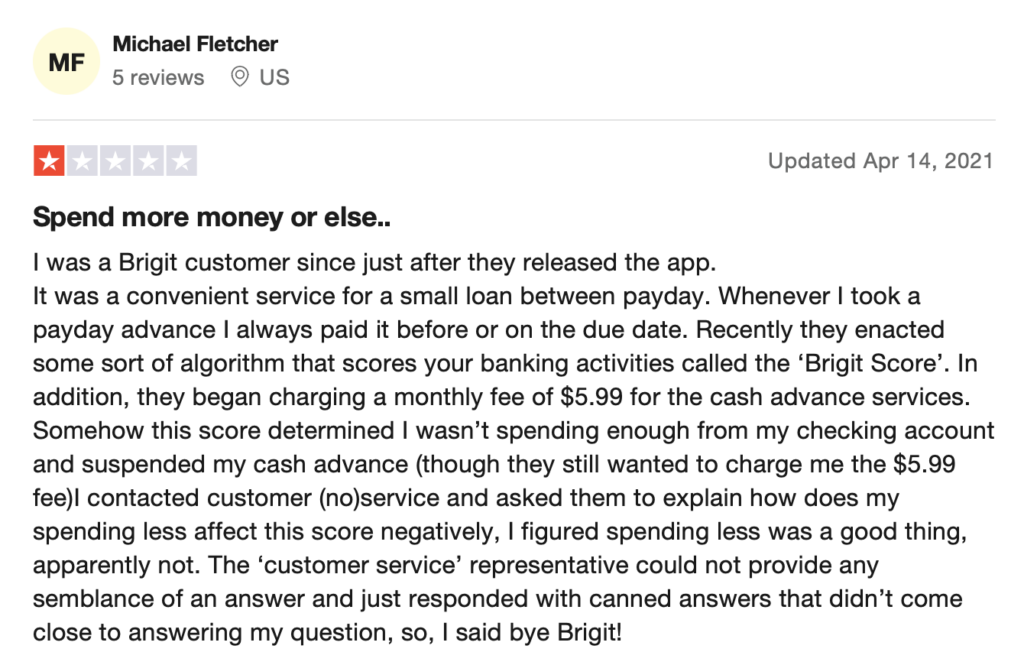

HomeReady try a specialist home loan system supplied by the new Federal Federal Home loan Connection (Fannie mae), among government-sponsored enterprises (GSEs) one facilitates use of sensible mortgage funding in the usa. It helps first-go out homeowners (FTHBs) and you may lowest-to-moderate-earnings borrowers in the achieving their think of reaching their think of homeownership. It allows borrowers to make use of money on give toward deal, whereas most other fund require fund are traceable or seasoned having at least 60 days.

Underneath the system, eligible property versions were that-device priily house, townhouses, condos, and you can arranged tool improvements (PUDs). Concurrently, are made construction qualifies and that is capped on financing-to-worth proportion out-of 95%. It also allows individuals to track down a limited cashout refi possibility to tap into the house’s security.

You to definitely known change away from good HomeReady program is their versatile earnings limits, that are according to research by the property’s area additionally the borrower’s city average income (AMI). This feature is beneficial to possess borrowers remaining in portion that have high houses can cost you, whilst . Alternatively, applications such as for instance FHA enjoys fixed-income restrictions, potentially limiting qualifications for some consumers from inside the high-prices nations.

HomeReady eligibility conditions

A HomeReady system offers glamorous terms and conditions and positives having low so you can moderate-income individuals. But not, like any financial program, referring which have eligibility criteria to own potential people. You need to meet with the following the HomeReady financing constraints.

80% urban area median income (AMI):

One of several fundamental qualification standards to possess HomeReady is your money. Your earnings shouldn’t surpass 80% of your own AMI into location of the possessions you plan to get. Which standards means that HomeReady priilies which have reasonable revenues, and make homeownership accessible in section with different prices-of-traditions criteria.

620 credit score:

In the event HomeReady are targeted at reasonable-earnings individuals, you really need to have a being qualified credit rating. If you’re conventional funds have more strict credit rating requirements, HomeReady it permits fico scores as little as 620.

Homeownership education:

Federal national mortgage association need HomeReady individuals to accomplish an online homeownership training direction. It degree role facilitate consumers better see the duties out-of homeownership, cost management and the homebuying techniques, making certain he is well-ready to accept to get a property for the first time.

HomeReady professionals

HomeReady financing stand out since the an appealing alternatives with the numerous masters that set all of them apart from other available choices. One secret advantage is the lowest minimum advance payment dependence on only step three%, rather less than of many conventional FTHB finance consult.

Fundamentally, a reduced downpayment helps make homeownership so much https://paydayloancolorado.net/crawford/ more accessible for people and you will families, especially those which have limited offers. It permits them to achieve their homeownership aspirations having quicker upfront cost.

At exactly the same time, their flexibility from inside the earnings data and credit requirements tends to make HomeReady a beneficial flexible choice one to address contact information exclusive economic things from a wide set of consumers. Once the an option, it gives reasonable-earnings borrowers that have a very clear path to homeownership while offering the latest pursuing the advantages.

Low down commission requirements – 3% minimum:

One of the first barriers to help you homeownership for some consumers was the challenge away from saving a substantial deposit. HomeReady’s low-down percentage requisite, as little as step 3% of one’s house’s price, produces homeownership significantly more available. Borrowers can enter the housing industry which have reduced initial bucks, which is especially very theraputic for those with minimal offers.

$2,five hundred borrowing from the bank to have down-payment and you may settlement costs

To handle ideal traps so you can homeownership HomeReady fund today were a $2,five-hundred credit for down money and settlement costs for low-money get (VLIP) borrowers. Individuals with a qualifying income out of below or equivalent to 50% of relevant urban area median money (AMI) of the subject property’s venue qualify. Consult your Mortgage Administrator to own eligibility.

Money independency:

Always, income accounts differ somewhat from the area. HomeReady considers brand new borrower’s earnings about the brand new area’s median money. Borrowers have to have a living that doesn’t exceed 80% of one’s area average money (AMI). This means that, individuals that have modest income , inside large-rates casing markets.

Being qualified income is sold with boarder earnings:

Lower than HomeReady financing direction, local rental money away from anyone leasing supplementary dwelling equipment or boarder during the the borrower’s first quarters is deemed due to the fact qualifying income.

Fixed-Price (FRM) and you can Variable-Price Home loan (ARM) options:

HomeReady enables you to choose between FRM and Sleeve. Consumers go for the soundness from a predetermined rate of interest or even the very first straight down attract mortgage rates generally in the Palms.

Lower mortgage insurance fees:

HomeReady has the benefit of reduced private financial insurance (PMI) premiums versus basic old-fashioned loans with low down repayments. The lower home loan insurance costs trigger cheaper month-to-month financial payments. More over, financial insurance is cancellable if the borrower’s equity exceeds 20%. PMI is generally eliminated for every FNMA Upkeep Book policy (limitations pertain).

Get and money-Out Refi offered:

HomeReady aids one another family commands and you may limited bucks-away refinances with a maximum financing-to-really worth (LTV) ratio as much as 95 percent. This is why borrowers can access their residence’s security to pay for some expenses otherwise consolidate financial obligation, so it’s a versatile choice for people trying re-finance the established home. Consult with your financial to your criteria and you can limits.

Debtor help:

HomeReady enables this new inclusion of low-borrower, non-renter income when you look at the determining the debt-to-earnings (DTI) ratio. Which independence can be helpful to own individuals who would like to enlist the assistance of family relations to help you be eligible for the mortgage. At the same time, it allows nonresident co-borrowers to have persons having handicaps.

Closure thoughts

Along, these features showcased significantly more than seek to reduce traps, bring monetary freedom and you may render told out of homeownership conveniently through the use of this choice. Talk to an experienced bank from your own financial or borrowing from the bank partnership to choose your own eligibility and mention exactly how good HomeReady can make your own homeownership dream an actuality.

Fundamental account and you can borrowing official certification implement. All the finance at the mercy of latest borrowing from the bank acceptance. Costs and you can terms and conditions try at the mercy of alter with no warning and so are dependent upon borrowing overall performance. Head to Ent/Courtroom to examine Ent’s Essential Loan Information and you can Disclosures.

Financial support on home in the Colorado. Possessions insurance is expected. Demand a tax agent for additional facts about deductibility interesting and costs.