PMI covers the lending company for the a domestic home mortgage out-of economic losing case the newest borrower non-payments on repayments

Another federal rules, introduced in We, which includes conditions. It entails feeling July 30, 1999 and, for brand new mortgages then day, demands cancellation off PMI at debtor ‘ s consult whenever new equity is located at, or perhaps is scheduled to-arrive, 20% when your borrower match particular conditions. It further need automatic cancellation of your own insurance policies when the security is located at twenty two% (a good 78% loan-to-value ratio) in case your debtor was latest to your his costs. What the law states contains some conditions having highest-exposure mortgage loans, however, forbids continuation of one’s insurance policies not in the midpoint of the amortization months in any case. It also need loan providers, beginning in July 1999, to make specific disclosures informing this new borrower off their liberties concerning PMI, for both brand new fund and you can established financing.

Brand new government legislation grandfathers certain existing county statutes that will be not contradictory, such as for instance Connecticut ‘ s newest disclosure standards. Additionally gives states which have this type of secure state legislation a-two-12 months window and come up with restricted improvement which are not inconsistent that have the latest government law.

Its entitled private financial insurance how to apply for a personal loan with no credit history to differentiate it away from authorities guarantees. Brand new debtor always pays the fresh premium, however, progress the main benefit of being able to pick a home at some point or becoming able to purchase a bigger home than just or even as the an inferior down payment needs. In place of PMI, lenders constantly want an excellent 20% advance payment. PMI protects the major 20% of one’s loan in cases where the latest borrower produces a smaller downpayment. Since most non-payments take place in the early several years of that loan, given that manager ‘ s guarantee remains reduced, PMI allows the lender and work out high-chance money than just otherwise.

Brand new borrower pays a first premium at closure (will half step one% of the loan amount) and you may monthly payments plus the month-to-month mortgage repayment. Instead, he might shell out a single-time single advanced. Advanced differ one of organizations. He could be according to research by the number of the new down payment, perhaps the loan is fixed-price or variable, whether or not the premiums was paid in a lump sum or monthly, and you can if people an element of the advanced is refundable.

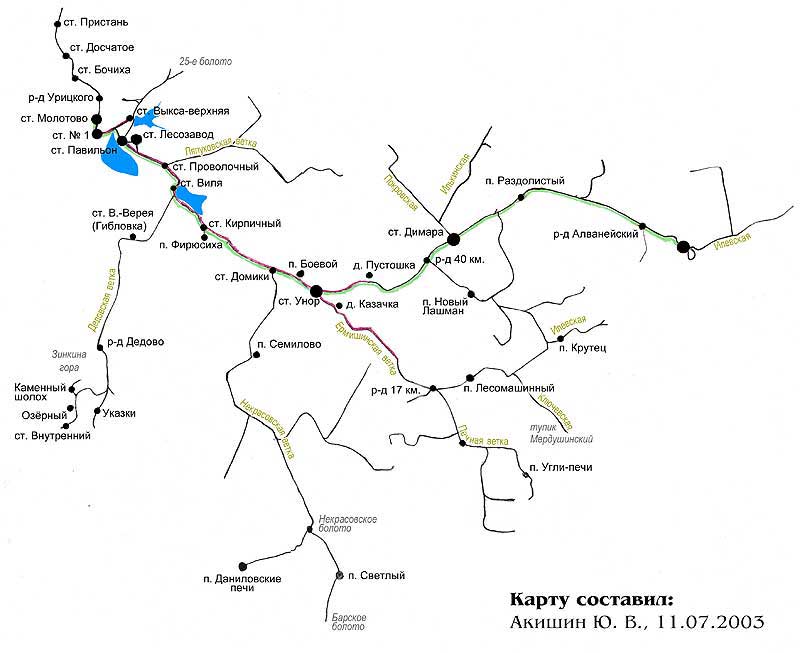

Guarantee Accounts At which PMI Is necessary

.png)

Lenders always require PMI into the money which have an initial mortgage-to-worthy of ratio greater than 80%, particularly if the loan providers offer the fresh fund to the supplementary mortgage I could stay on home financing towards full 31-12 months identity otherwise through to the mortgage try reduced, until brand new debtor requested the treatment together with lender otherwise manager of the financing arranged. Federal national mortgage association and you may Freddie Mac have for a long time allowed cancellation away from the insurance to have consumers with an excellent percentage histories whoever guarantee reaches 20%. However, no federal rules and simply several county regulations, including Connecticut ‘ s, expected you to definitely modify consumers of this solution.

Connecticut laws lets county-chartered banking companies and then make money over a great 90% loan-to-really worth proportion if they are protected by an excellent PMI rules regarding a personal financial guarantee company subscribed of the insurance rates administrator so you can do business on the county and authorized by the banking administrator (CGS 36a-261(I)(8)).

REFINANCING

Unless of course it is cancelled, the initial PMI offer lasts for the life of your own loan. Refinancing any kind of time section takes away that certain coverage, however it is up to the fresh new lender so you can I was required for the the new loan, according to the the fresh new financing-to-really worth proportion.

Jurisdiction

At condition height, the insurance Company certificates individual home loan insurance firms therefore the Financial Agency administers a laws requiring loan providers to make certain disclosures to individuals on the PMI. What the law states requires people financial and come up with a consumer first-mortgage mortgage on a single- to four-relatives property to disclose into the borrower during the time the guy documents the borrowed funds app: